Insurance may be a confusing topic. We may think that the car insurance industry has done that to itself with commercials that point out everything except what is extremely necessary to most customers and their families. What does one actually need to know? It looks like everything could be a huge secret. This article may assist you de-mystify the deal and help you to understand what is really necessary to you.

Cheap Car Insurance Is Good, Right?

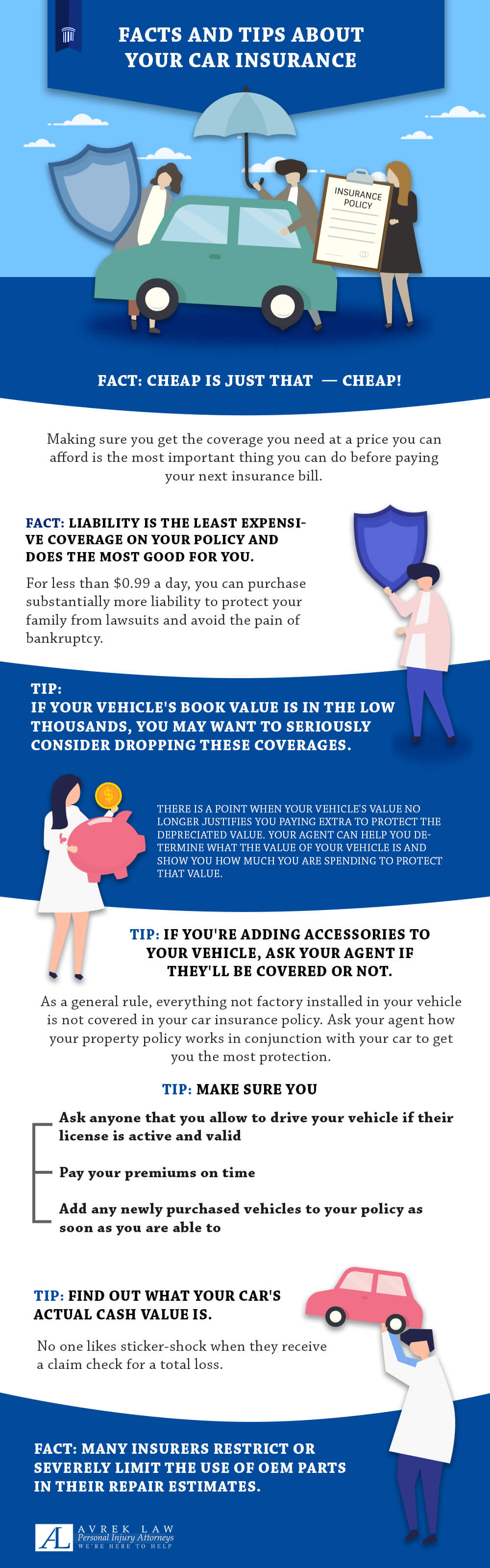

We know, we’ve seen all a similar commercial on TV to the one you just have. Everybody tries to out-shout one another claiming they will save you a lot on your insurance. Price is very important, but it isn’t everything. We usually tell purchasers that it is the same as shopping for something else:

You’ll usually get what you buy. If you were searching for a pair of shades, and you found a pair for $5 at a shop — you’d expect to get a pair of $5 shades. Thus, once they were lost or broken or did not suit your face right, you would be comfortable with that as a result of you know you purchased a pair of $5 shades.

However, if you acquire a pair of prescription, designer shades from your local optometrist for $200, you’d expect to get something that would not easily break or scratch, something which would be very comfortable to wear. In essence, you’d expect to steer out the door with something of outstanding quality. The same goes for insurance and anything you get. Anyone can sell you a cheap insurance policy, and that is simply what you will get.

What Is the Most Important Coverage I Will Need?

Most States have obligatory, required liability limits for a reason: Promoting Public Goodwill! Liability is the part of your policy that pays for medical bills and property damage that you simply are legally liable for if you are determined to be at-fault in an accident. However, most of those limits were established in the 1970s, when the price of healthcare and property were considerably less than they currently are. The average annual financial gain in 1975 was $8,000!

The States have not kept pace on the required liability limits with the rising prices of health care or even inflation! When is that the last time you heard of a case for fewer than $1 Million?? If you’ve got $15,000 to $30,000 to throw at a case that size, where are you planning to get the rest?? Liability limits are offered from the minimum State requirements all the way up to $2 Million for any bodily injury or property damage that results from a car accident. Without enough liability, you may be faced with financially devastating lawsuits if you hurt someone badly during a car accident

What is Full Coverage?

There is no such thing as “Full Coverage.” If an insurance firm sold you each coverage that they had in their arsenal, there would still be things that would not be covered. An example of this can be using the vehicle for criminal activity. Running from the police, smuggling medication or any outlawed substances or individuals, and intentional criminal acts are good examples of things that may never be covered if your vehicle was damaged or destroyed.

There Are Only Two Coverages You Are Able to Purchase That Can Be Referred to as “Full Coverage.”

Collision coverage is the first one of these. A collision is the only place in your policy where you will be able to get cash to repair your vehicle if you wreck it and it is determined to be your fault. In the No-Fault States, like Colorado, if your vehicle was damaged in an accident, your Collision Insurance is the only place you would find the funds to repair your car, even if the accident was caused by some other driver.

Comprehensive coverage is the second one of these, and it protects your vehicle from non-collision related losses like fire, wind, hail, theft, vandalism, falling objects like trees and falling rocks from a hillside, and hitting animals.

Typically, banking institutions will force you to have these coverages while you are financing a vehicle so they — the bank — are financially protected from loss if the vehicle were to be in an accident and end up wrecked or destroyed while they are still carrying the note on it.

If I Am Covered Under My Major Medical Provider, Do I Really Need Uninsured Motorist Coverage?

If you are paying some other person for health care coverage, why would you wish to pay another insurance firm more cash for a similar thing? In most cases wherever vehicles are covered with Collision and Comprehensive, and wherever you have got health care coverage for you and your family with a serious Medical provider; It does not matter if an uninsured person hits you and hurts you. You already know your medical bills are going to be paid anyway by your Major Medical provider.

If Have Expensive Aftermarket Rims and Tires or Stereo Equipment Installed on My Vehicle, Will Those Items Covered By My Policy?

We know clients that have paid a considerable quantity of money in order to “customize” their vehicle. Some of that spending has gone upwards of $10,000 in order to get accessories that help them make their vehicle look completely unique. The fundamental rule of thumb to see if these valuables are covered under your insurance policy, and that is pretty straightforward.

“If they are installed as a replacement for factory components, you are covered.”

Rims and tires are clearly going to be installed in the same location as the rims and tires that came with the vehicle from the factory. Stereo equipment is going to be put in the same spot as the factory stereo. However, a number of the accessories, like amplifiers and speakers that are placed in alternative spots, like under the seats, within the trunk of the car, are not covered under your personal car policy with any insurance provider.

Is My GPS, Cell Phone, or Radar Detector Covered If My Car Is Broken-Into and They Are Stolen?

Your policy will only cover the vehicle. Personal property stolen from the inside a vehicle will never be covered under a car policy. Only a Personal Property policy, like Homeowners, Renters, or Manufactured Home insurance will cover personal property inside the vehicle.

What Will Cause My Car Insurance Claim to Be Immediately Denied?

Car insurance companies all have the same basic set of rules for this they outline in the policy document. The main reasons your car accident claim could be denied are:

- Driving the car without a license or on a suspended license

- The Coverage was lapsed at the time of the accident

- A newly-purchased car was not added to the policy within the 30-day window after the car was purchased

If My Car Is Totaled, How Much Will the Insurance Company Pay To Cover The Loss?

Generally, most major insurance firms will cover your vehicle for its “Actual Cash Value.” Actual cash value is the depreciated value of your vehicle at the time of the accident where it was totally destroyed. Each insurance firm has their own system for valuing vehicles. The closest you will be able to get to the present rate is by averaging your Kelly Blue Book values for trade-in and private Party.

This may provide you with an excellent idea of the typical value an insurance firm can pay you if your vehicle is destroyed. This can be the highest value or the lowest value on the market to you as the owner of the vehicle. Some policies, typically for traditional Cars, enable you to insure the vehicle for declared value or “agreed-upon value”. Most personal car policies don’t enable you to insure a vehicle for declared value.

If I Need New Parts for My Car, Will My Car Insurance Company Pay For Original Manufacturer Parts?

In the past, many insurance companies guaranteed original manufacturer parts. When major car companies were badly hit in the recession, many of them got stuck assuming those parts would be readily available. When insurance companies were faced with a shortage of car parts made by companies that were now bankrupt, all of them changed the wording of their policies this in order to protect themselves from lawsuits. It is now the norm for aftermarket parts to be used to repair vehicles, as they are more readily available and no noticeable difference is visible in the repairs most body shops make.

What If I Am Killed In a Car Accident? What Will My Family Get?

Most people assume that if they are killed in a car accident that their family can receive some kind of benefit from the car insurance firm. That’s simply not true. Some States offer a small benefit in their medical payment/personal injury protection coverage. However, most do not. Medical Payments’ coverage pays up to the policy limits for medical bills only.

We know the world of insurance is confusing. However, it is important to understand what are proper questions to raise your agent so you may be in a position to make well-informed choices for you and your family. We believe that when you are properly educated regarding insurance, you experience as a whole is going to be far bearable.

If you or a loved one has been having trouble with their insurance company, or their coverage has been denied, contact one of our attorneys today!

How much is your case worth?

Get a free case evaluation