Uninsured motorist coverage (UM coverage) and its homologous, under-insured motorist coverage (UIM coverage) are special clauses whose details, functioning and so on are little known to U. S. citizens. That is why we set ourselves the task of doing some articles (this is the second, the first one was recently published and you can easily find it in this section) to explain the essential aspects of these clauses.

The first issue was contextualization-oriented: we gave a simple definition of UM coverage and then covered the rest of the article with statistics on the number of uninsured drivers, both nationally and at the state level. We also dedicated the final part of the text to providing the most frequent reasons for the decision of American drivers not to purchase automobile insurance. If you have not yet read the first article, we extend to you an invitation to do it right now.

However, in this second article, we will go into the details of both clauses: how they are applied, how they work, what their cost is, among others. Always making sure that the explanations are comprehensible to the public, but at the same time not simplifying, but appropriately attending to each detail.

With all this cleared up, we can begin.

What if I had a collision with an uninsured motorist?

Normally, see, a collision with an insured motorist who was legally responsible for the accident, you file a personal injury claim with the insurance company of the motorist responsible for the collision.

However, in the scenario where the motorist lacks an automobile policy, the issue gets a little complicated and not so simple. In these cases, your scope for action is quite limited and you can only file a personal injury claim directly against the guilty motorist, so that you can obtain compensation for the damages caused – which are never small.

However, you should keep this in mind: if, as we said in the last article, the most frequent reason why a driver does not purchase a policy is because he does not have the financial muscle to do so, then what kind of compensation could you expect from a personal injury claim directly against a person who does not have any money to even pay the insurance premiums?

The only way for an uninsured driver who is legally liable for an accident to pay compensation would be to sell his property. And yet, the driver will reach a point from which he or she will no longer be able to spend money.

On the other hand, from a legal point of view, a judge cannot do anything to reverse that situation. In fact, there is something called “judgment proof” and they are those people who are guilty of injuries or damages to third parties and are not in an economic situation that allows them to compensate for the damages they caused.

It is clear that the judgment proof is quite unfair, since it practically “acquits” the culprit of compensating for the damage caused. But what’s the other option? The law does not stipulate other alternatives (and there really are no alternatives either), so there is no alternative. With the exception of slavery, but that’s unthinkable. Apart from the fact that it is morally reprehensible, the law does not contemplate anything like that either.

That is why personal claims of this kind are counterproductive and do not produce a result that is exactly satisfactory to the plaintiff.

In the light of the foregoing, we can provide the following answer to the above question: if you are a victim of an accident with an uninsured driver, you will not be able to obtain fair compensation. In the worst case, you will not be able to obtain even the slightest compensation for injuries and damages resulting from the accident for which you have not been responsible. Of course, there may be exceptions, but that’s what they are: exceptions. The odds are not in your favor in this kind of scenario.

But if you purchase UM coverage, you can rest assured that you will receive compensation for your injuries. If you have UM coverage, and you have an accident with an uninsured driver, your insurance company will pay for all expenses necessary to mitigate the consequences of the accident. But the details and scope of coverage will already depend on each insurance company’s policies.

How exactly does UM coverage work?

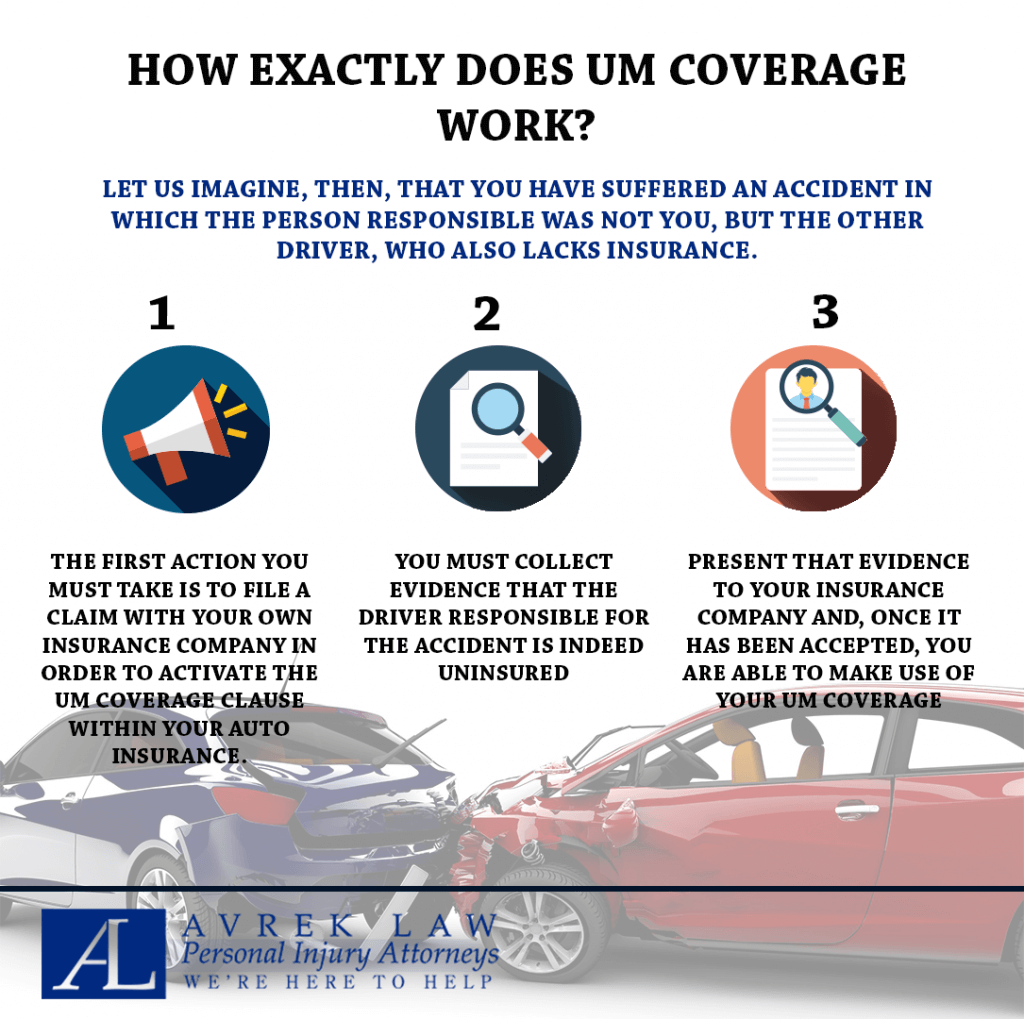

Now, suppose you have purchased UM coverage and it is fully included in your policy. Let us imagine, then, that you have suffered an accident in which the person responsible was not you, but the other driver, who also lacks insurance. The first action you must take is to file a claim with your own insurance company in order to activate the UM coverage clause within your auto insurance.

Once you have filed that claim, you must collect evidence that the driver responsible for the accident is indeed uninsured. Afterwards, you present that evidence to your insurance company and, once it has been accepted, you are able to make use of your UM coverage, so your insurer must bear the costs related to the replacement of the damage caused.

But it is important for you to know that UM coverage has its specifications. One is that it is classified into two categories: coverage for bodily injury, injury or damage on the one hand; coverage for property damage or destruction on the other.

But what exactly does bodily injury coverage cover? Basically, all those medical expenses, including short, medium and long-term treatment, as well as the medications required for a full recovery of your body condition.

While, on the other hand, coverage for property damage covers any damage to your vehicle, as well as any other material damage resulting from the collision.

Generally, insurance companies offer you the ability to contract them individually, i. e. you can purchase UM coverage that only contains coverage for bodily injury; or you can purchase UM coverage that only provides coverage for property damage. When it comes to health, you should not skimp, so it is highly recommended that you hire both coverages and not just one.

In fact, many of our customers have said that UM coverage has literally saved their lives., we have ample anecdotal evidence to support that UM coverage is extremely important and worthwhile to purchase. We’re not promoting any insurance company. We are simply telling the truth in all its purity.

The odds of me being in an automobile accident are very low, and the odds of me being involved in a collision with an uninsured driver are even lower. The same statistics you provided show that “you may be thinking. And that’s a valid reproach. However, keep in mind that after an accident, life is not the same again. And even though it is very small, there is still the possibility that you may be a victim of an accident with an uninsured driver. And when that possibility becomes a reality, you will regret not having included the UM coverage clause in your policy.

Don’t wait to be part of the statistic to consider acquiring UM coverage.

What is UIM coverage?

To finalize this informative article, we will explain the UM coverage homologue: UIM or underinsured motorist coverage. Although both clauses have a fairly high degree of similarity, they are not the same and it is important not to confuse them.

UIM coverage is a special clause (or Premium), as well as UM coverage, which is used in a scenario where the insured has been involved in an accident where the responsible party has been a motorist with a policy whose coverage is not extensive enough to cover all the costs arising from the accident.

The great detail of the UIM coverage is that its activation is not immediate. In other words, the UIM coverage cannot be used as a first option but can only be used once the coverage of the policy of the person responsible for the accident has been exhausted in its entirety. In other words, UIM coverage is just the last of the alternatives.

In addition, there is another condition sine qua non for the enjoyment of UIM coverage: the amount of this clause must be greater than the amount of the limits of the driver’s liability insurance for the accident. Let’s put it this way: if the culprit’s liability insurance covers up to $30,000 and the amount of your UIM coverage is $30,000, then you can’t get compensation money through this clause.

If, on the other hand, the UIM coverage were to cover a greater amount, such as $40,000 or $50,000, then you would be entitled to require your insurance company to apply for UIM coverage.

As a last point, keep in mind that the UIM coverage may also contain two types of coverage, as well as the UIM coverage. And if you have properly analyzed all the information we have provided, then you will know that the most rational option is to contract both coverages.

How much is your case worth?

Get a free case evaluation