This is not the first time we have talked about so-called uninsured motorist coverage (hereafter, UM coverage). However, those occasions where we have mentioned it have not been in a detailed and explanatory way. This coverage generates a lot of doubts; and we know this, since most of our clients do not have a clear knowledge about this coverage.

Basically, there are 3 questions our clients usually ask us about this particular coverage:

1) Is this coverage very important? Should I buy it or is it not worth it?

2) Will this coverage benefit or harm me?

3) What is the cost of its acquisition? Is it too expensive?

Thus, this new article is an attempt to answer each of these questions – which are more frequent than you might expect. We will explain the core elements of this coverage and the basics that every U. S. citizen (but especially the California citizen) should know about it. We will also discuss how this coverage works and why, in most cases, it is highly advantageous. Of course, we will mention underinsured motorist coverage (hereafter referred to as UIM coverage), which is very similar to UM coverage.

Although UM coverage is applied in almost all states of the nation, and its mechanics are virtually the same in each of them, there are aspects within it that will depend on the legislation of each particular state. This article, for example, is aimed at clarifying UM coverage in the State of California. However, you can inform yourself with this article regardless of whether you live in another State.

Let’s get started.

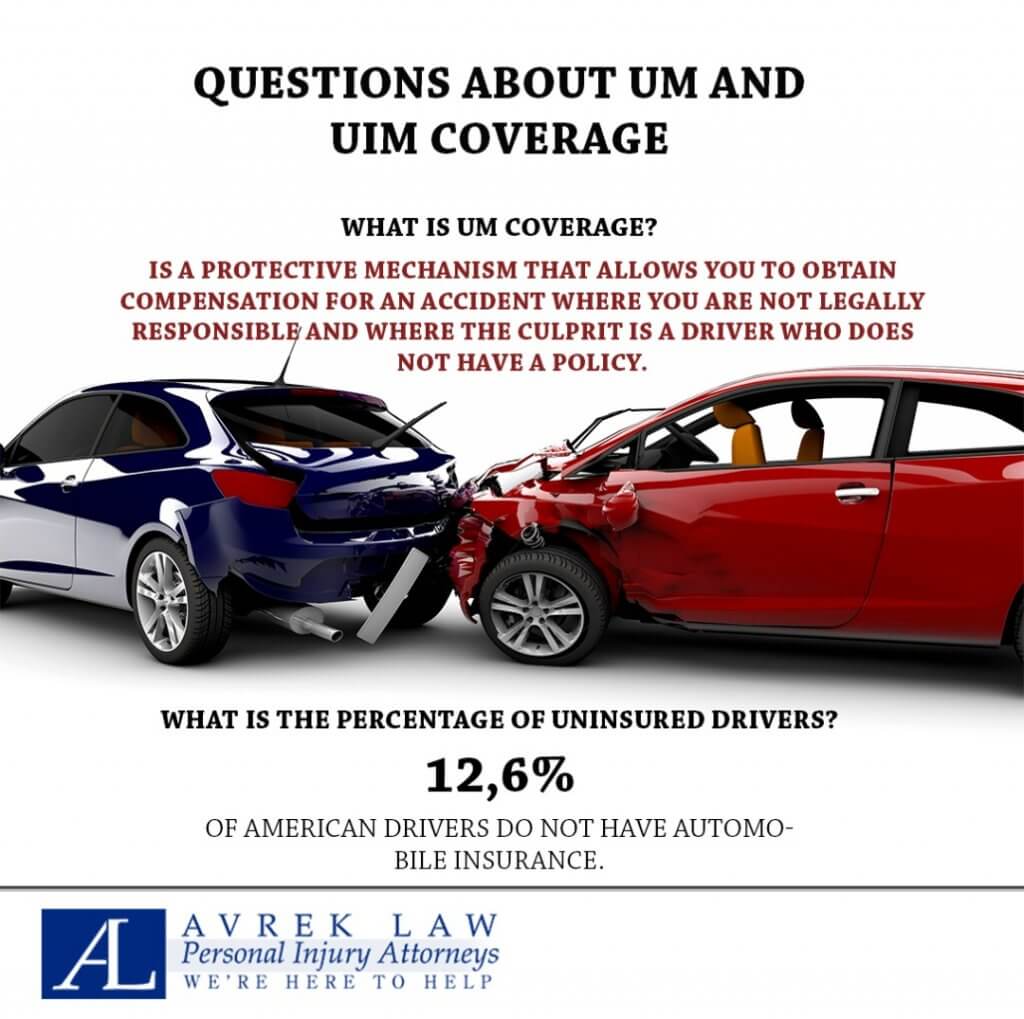

What is UM coverage?

To put it very simply: UM coverage is an add-on clause (a premium clause) to automobile insurance that offers protection to the policyholder in case he is a victim of an accident where he is not responsible, but the fault lies on an uninsured driver. In short, it is a protective mechanism that allows you to obtain compensation for an accident where you are not legally responsible and where the culprit is a driver who does not have a policy.

“Wait a minute! Every driver is supposed to have automobile insurance. That is stipulated in the law. How can that be possible?” is a thought you probably had when you read the previous paragraph. And you’re right: California law (and most states’ law, in fact, with the exception of New Hampshire and Virginia) makes automobile insurance mandatory for any driver. However, you should be very clear that the law is often ignored by citizens on many occasions, so it is common to witness cases of uninsured drivers.

And the worst thing about it is that, at least in California, an uninsured driver can face substantial penalties. And yet, a majority of drivers do not have an automobile policy.

What is the percentage of uninsured drivers?

It is not possible to provide an exact answer to this question, although we can say that the percentage of uninsured drivers is very high. However, the Insurance Information Institute (III) has revealed a fact that is useful to understand the magnitude of the problem: approximately 12.6% of American drivers do not have automobile insurance.

Fortunately, III has disaggregated this statistic at the state level, so we can know the percentage of uninsured drivers in each of the country’s states. Based on the data provided by III, Oklahoma ranks first with 25.9% of uninsured drivers. On the other side, Massachusetts ranks last with “just” 3.9% of uninsured motorists.

And what about states where the law does not make insurance mandatory for drivers, namely Virginia and New Hampshire? Are they at the top of the list? Although it may seem illogical, actually both states are in line with the general trend (i. e. their percentage of uninsured drivers is almost the same as other states); in fact, being more specific, they are slightly better in that sense than the rest of the states: Virginia is ranked 31st with 10.1% of uninsured drivers, while New Hampshire 34th with 9.3%.

Why do these States not have the highest percentages? To answer that question, it is necessary to do a multi-causal analysis that escapes the purposes of this informative article. But it is possible to draw a conclusion from these statistics: the mandatory nature of motor insurance has no impact on the number of drivers without a policy.

And where does California stand on all of these? According to the data provided by III, our state is in the middle of the list, with a percentage that is slightly above average: approximately 14.7% of drivers in the state of California do not have motor insurance.

Seen another way, 1 in 7 California drivers lacks a policy. This troubling statistic can also be seen in two other ways: (i) if you randomly choose a car in California, the chances that its driver does not have insurance are 1 in 7; (ii) likewise, if you have a California car accident, the odds that the other driver is uninsured are 1 in 7.

Official statistics reveal that more than 3,000 people die annually in California’s auto accidents, while thousands more are injured, whether mildly or severely. And that’s without counting property damage. Then it is worrying that 1 in 7 drivers in California is not insured, which means that they are not in a financial position to compensate for the damage caused.

Why is the percentage of uninsured drivers so high?

Suppose this (quite predictable) dilemma: being insured or uninsured. Naturally, the most rational decision is to be insured, because if you don’t have a policy, and you are legally responsible for an accident, you will have to pay out-of-own-pocket for a large number of expenses (damage to property, medical care and so on). At some point, you will no longer be able to bear the costs and you will inevitably go bankrupt.

In addition, the California penalty for uninsured drivers is quite dissuasive: your license can be suspended, you must pay a fine, and there is a chance that you will lose your car. And don’t believe that these sanctions are exclusive to Californian regulation: on the contrary, these sanctions are also found in the laws of other states. So why is the percentage of uninsured drivers so high?

There are several reasons behind a driver’s decision not to purchase insurance. Some people don’t hire them by mere carelessness: they don’t give them much importance or they just forget. While others prefer to keep as much distance as possible from the authorities, either because they are wanted by them, or because they are not legally in the United States. However, these reasons are not convincing enough to explain why a large proportion of motorist’s lack insurance.

Actually, the most frequent reason is the following and it is simpler than you think: they do not have the economic capacity to acquire it. Some drivers earn a living or their jobs require them to drive a vehicle, so they are usually faced with the costs of maintaining the vehicle, such as repair costs and gasoline. And for these people, what is more important: investing money in repair and gasoline; or investing money in paying policy fees? The answer is quite obvious.

In fact, this assertion that drivers do not buy insurance because they cannot afford it can be supported statistically: if one looks at the percentage of uninsured drivers during the financial crisis in 2008, a considerable increase can be noted; on the contrary, if one looks at this statistic in the periods when there was a certain economic boom, a downward trend can be observed.

For now, we’ll leave this issue here. For reasons of adherence to our format, we cannot expand any further, but we will talk more about it in another article. That is why we invite you to follow us and be very attentive to us so that you can be informed.

In another delivery we will explain the mechanics of UM coverage (how it works); what exactly is UIM coverage, which is very similar to UM coverage; whether these clauses are mandatory or optional; among other things.

We also recommend that you consult with other professionals in the area so that you can form a clear opinion about UM coverage and UIM coverage. The important thing is that, as a U. S. citizen, you are aware of their importance and the benefits they offer.

How much is your case worth?

Get a free case evaluation